Kite: the free debit card for kids

Kite: the free debit card for kids

Manage your kid’s pocket money from your Starling account with our award-winning free debit card and app for 6-15 year olds.

How to apply

Keep it simple with Kite

Easy set up

From your Starling personal or joint accountInstant phone notifications

Every time your child spends or receives moneyAutomatic top-ups

For weekly or monthly pocket moneyA free Mastercard debit card

Made from 95% recycled plastic!

Why choose Kite?

It's free!

No hidden fees from us, for example for topping up the card or using it abroad. For a full breakdown, check our rates, fees and charges.

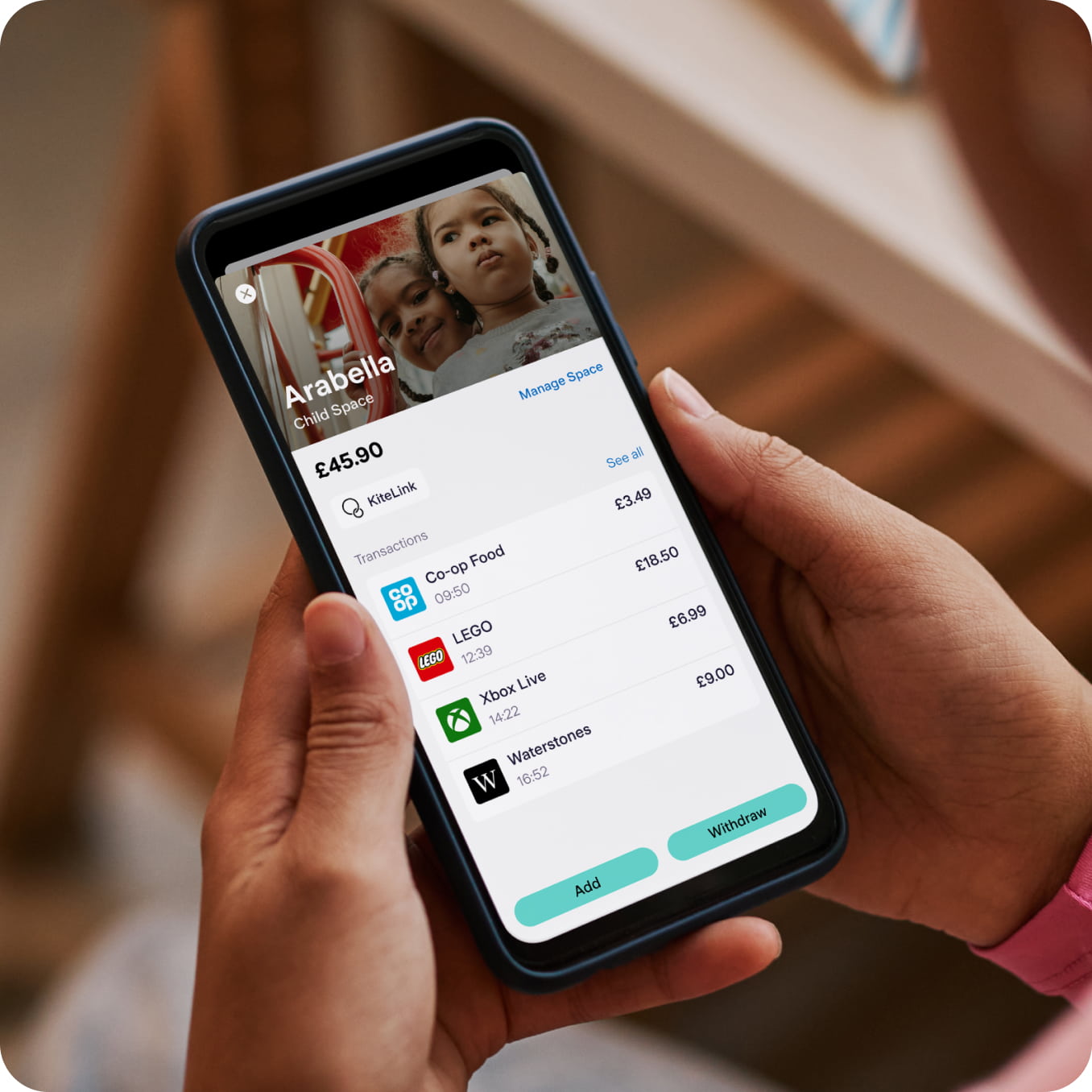

A kids version of the app

Less pestering, more power - kids can check their balance and track their spending from their own device, not just by looking at your app.

Stress-free birthday money

Allow family and friends to put money on your kid’s Kite card with a unique and secure KiteLink. No account details, no cheques, no nonsense.

Smart money tools

See how your kid spends their money. Set controls, access their balance and spending history - and start money conversations with them.

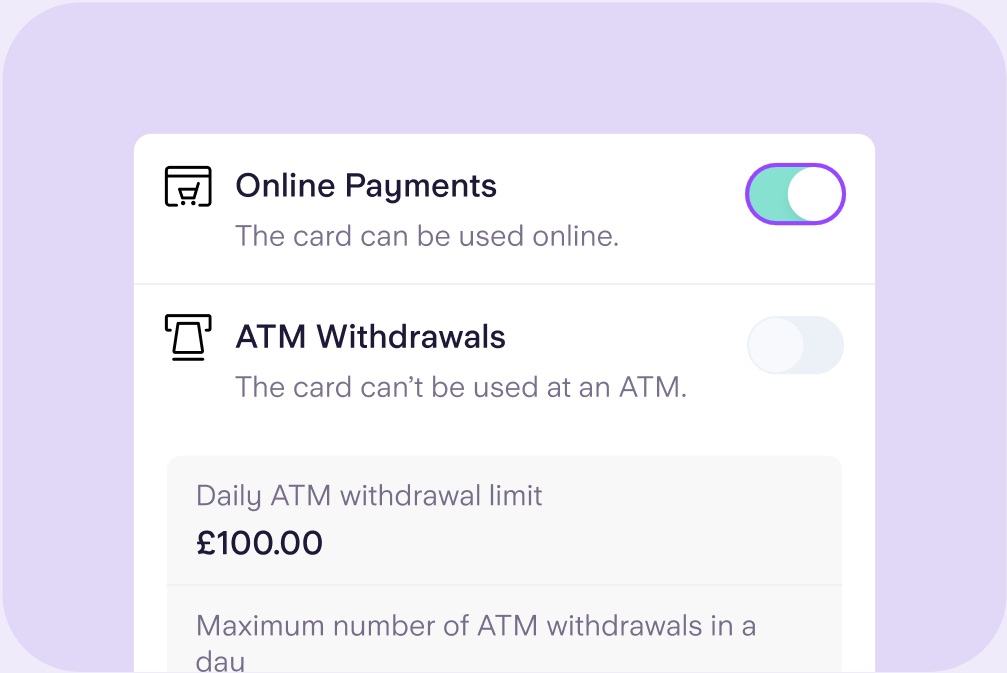

Grown-ups set the boundaries

Choose a daily spending limit to control your child’s spending

Get an instant phone notification when they spend money

Lock the card instantly if it’s lost or stolen

Top up the card with a tap, 24/7

Track their spending history directly from your app

Manage Kite as a team (when you set up Kite from a Starling joint account)

Set controls for the card and block online payments or ATM withdrawals

You’re still the primary account holder, so the money you add to Kite is covered by your account’s FSCS protection up to £85,000

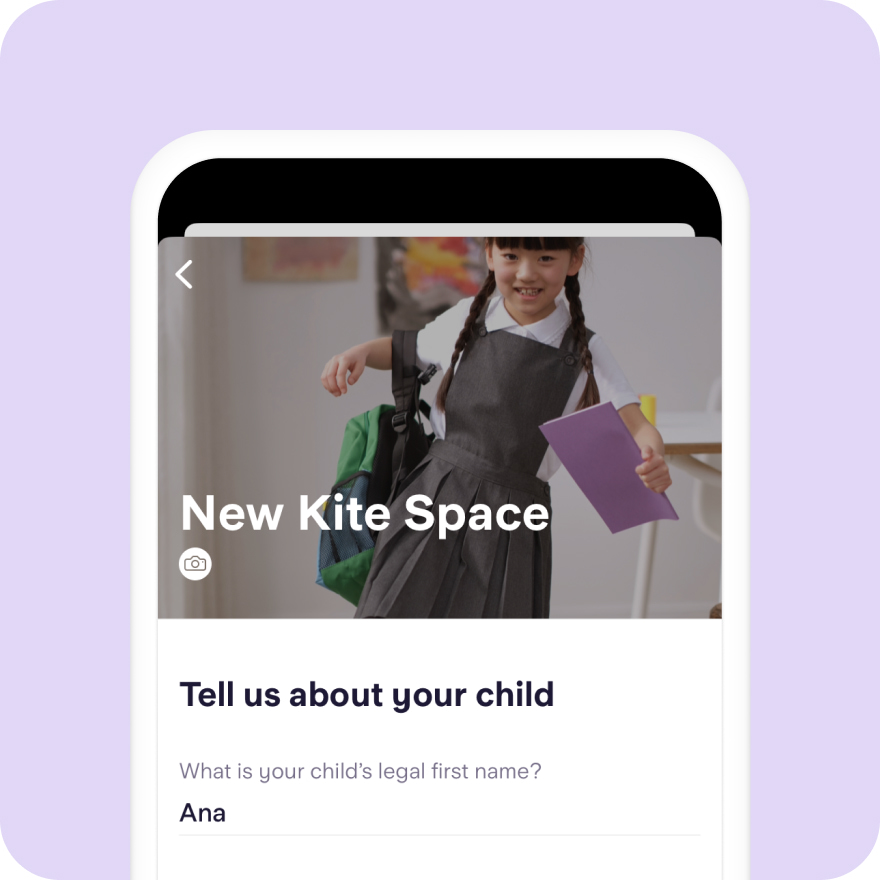

How to set up Kite

New to Starling? To get Kite, you’ll need our award-winning current account first. This is because your child’s card is linked to a Space within your current account. Kite is not a separate children’s bank account.

Benefit from 24/7 support, world-class security, no fees from us from spending abroad, and a whole range of easy-to-use money management tools - all part of your fully regulated UK bank account, on an easy-to-use app. Recommended five years in a row by Which?.

Tell me about the current account

Ready to get Kite?

Do either of you bank with us already?

Step 1

Before you apply for Kite, you’ll need a personal account with Starling - apply by downloading the app. Once approved, you can apply for a joint account or go straight ahead and set up Kite.

Step 2

From your personal or joint account, go to ‘Spaces’ and tap ‘Kite Space’. We’ll then ask for some details and a photo of your child’s ID (UK birth or adoption certificate, residence permit or valid passport).

Step 3

That’s it! Once we’ve approved your application, your Kite card will be on its way to you. Delivery usually takes 3-5 working days. You can add money to your Kite Space right away.

Subject to eligibility: the option to apply for a Kite Space in the app is only available to customers 18+ and who meet our criteria.

Already a Kite customer?

Find out how you can claim two free kids lunches at a National Trust space this Summer.

Frequently asked questions

How do I set up the kids’ version of the app?

Once your Kite application has been accepted, you can set up the kid’s version of the Starling app, if they have their own device and it’s something you want to do - it’s optional.

The process uses nearby pairing, so make sure you are near each other when completing setup. To set up access to the Starling app, head to the Kite Space in your app, tap ‘Manage Space’, then the button to set up an app for your child and follow the on-screen instructions.

How do I add money to my child’s Kite card?

Adding money to a Kite card is simple, just go to the Kite Space in your app, tap Add and enter the amount. The money will be instantly available to spend on your kid’s bank card.

You can also choose to set up a regular transfer to the Kite card, for example for weekly or monthly pocket money.

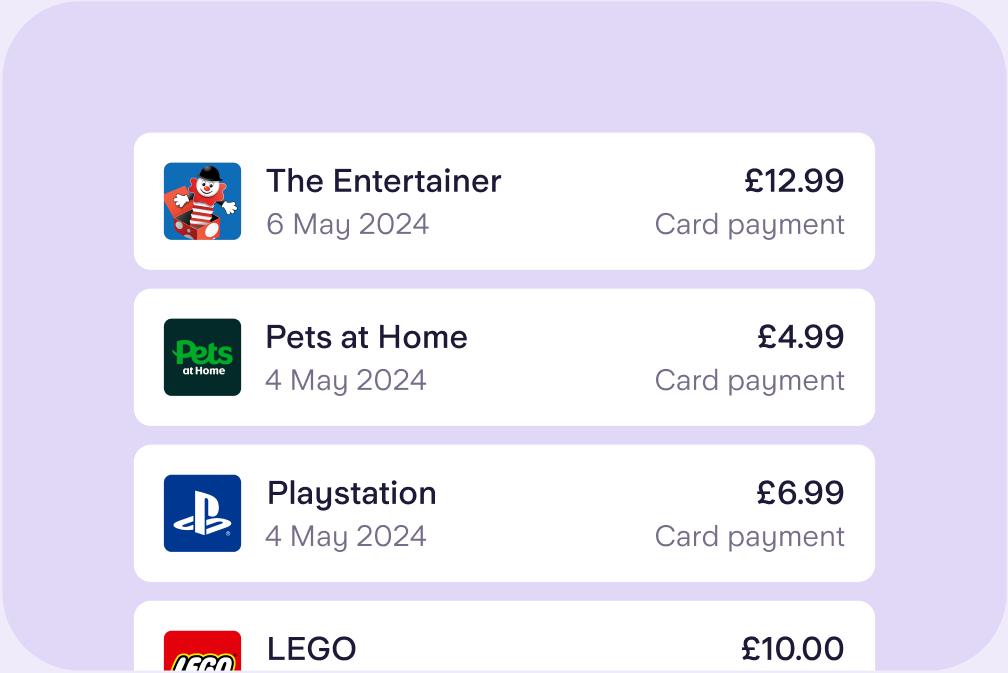

Where can my child use their Kite card?

Your child can use their Kite card for ATMs and anywhere they see the Mastercard logo: online, on the high street, on a bus, both at home and abroad, with no fees from us.

To keep children safe, we’ve added a block for several merchant categories, including pubs, internet gambling sites, betting establishments, pawn shops and video game arcades. While we expect that most of these types of transactions will be blocked, it’s possible that an individual merchant might have set themselves up in a way that means transactions won’t be blocked. You can keep an eye on your child’s spending through instant notifications and by looking at their spending history, visible in your Kite Space.

Can a Kite card be used to make contactless payments?

Yes, a Kite card can be used to make contactless payments up to £100, after the first Chip and PIN payment has been made. The contactless limit for Kite can be lowered by the adult that ordered the card. You can do this by going to your Kite Space.

What happens when my child turns 16?

Once your child turns 16, they can then apply for a Starling Teen account - find out more here. The Kite Space will remain open until the adult in charge of it cancels it. When cancelled, any money left in the Kite Space will be moved back to the adult’s main balance.

Looking for more help?

Visit our help centre for a full range of frequently asked questions on Starling Kite. It’s often the quickest way to get the answers you need - from within the app or online.